Trent Ambler, MSF | Portfolio Manager

Key Point: Market timing is a dangerous game

Implication: Investors should not be overly concerned about market corrections, consistent equity exposure yields great benefit despite inevitable drawdowns

______________

On July 16th, 2024 the S&P 500 price return index achieved a new multi-decade high closing at 5,667.2. Since then, in the face of some concerning macro-economic data, the market has sold off, somewhat precipitously, closing at 5,186.3 on August 5th, 2024 a drop of nearly -8.5%, figure 1. Over that same period the VIX moved from a very pedestrian 13.19 up to 38.57, marking the biggest intraday jump since 2020. Such moves often inspire concern amongst equity investors and naturally cause some to consider their equity allocations in advance of what might be a larger sell-off.

Figure 1 The S&P 500 Price Return Index

Against that backdrop it is helpful to frame the current move in relation to previous market corrections and offer some context on the ever-interesting debate around predicting market moves and tactical timing decisions. In short, is there anything to be gained from attempting to predict and therein time the market?

Since 1980 the average correction in the S&P 500 price return index tends to be on the order of -22.0% and lasts 184 days. In that time there have been 19 corrections (defined here as a drawdown of at least -10.0%), figure 2.

There is great temptation to take such data and attempt to gain some understanding about where the market might go next. Are we in a recession or is the current move just a blip in the middle of a longer bull market. Recessionary corrections tend to be longer and deeper than non-recessionary corrections and so even this seemingly simple analysis stirs questions about equity exposure. It can be painful to watch a market correction unfold. Portfolios take a hit and there is great temptation to adjust equity allocations, whether that be in the form of not investing, getting out, or even taking a decidedly more negative bet (increasing short positions or adding bearish derivative exposure for example).

Such moves are often made from a place of bias. Fear around a coming drawdown can trigger behavior which ultimately, over a longer horizon, proves damaging to future returns.

Figure 2

With each decision to trim equity exposure in the face of an anticipated correction there comes an equally challenging decision around re-entry. If upon careful consideration equities are assigned some level of exposure within a larger investment portfolio and the equity allocation is trimmed for fear of a drawdown, even if that call ultimately proves correct, an investor risks mismanaging the task of calling the bottom when equity exposure ultimately needs to be re-established.

A great deal of analysis has been done on potential signals which might aid in making such calls, macro-economic data, technical analysis, election cycles, market level fundamentals, all have been used as candidates for building a model which might inform tactical asset allocation. Putting aside the actual efficacy of such models, the goal is perfect or at least near perfect timing for exiting and re-entering equity markets in advance of an anticipated move. But even without identifying an appropriate timing model and allowing for perfect foresight what would an equity investor gain by executing a strategy which say decreases equity exposure and subsequently and proportionally increases exposure in another asset class (cash or bonds for example).

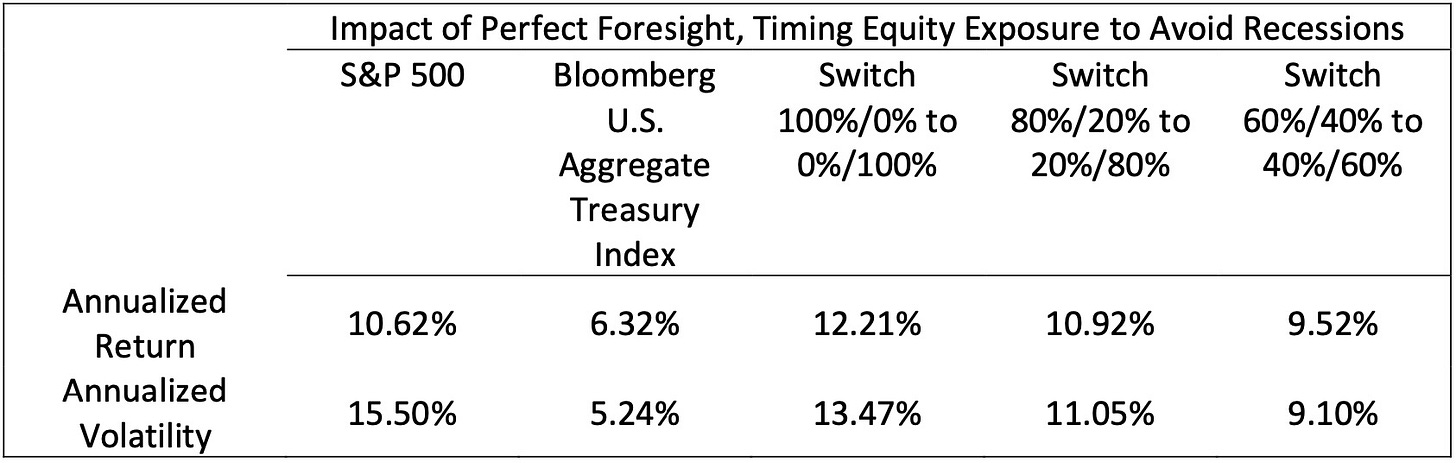

A recent study out of the NYU Tandon School of Engineering asks this precise question and the findings are somewhat surprising.[1] For an investment period spanning 12/31/1972 – 12/31/2023, gifting an investor with perfect foresight of coming recessions and allowing that investor to exit equities while also increasing bond exposure in advance of the coming market drawdown has surprisingly little impact on realized returns, figure 31.

Figure 31

Even with the gift of perfect foresight there is very little to be gained from a tactical allocation strategy which successfully avoids equity drawdowns during a recession. An investor who gets out of equities entirely and switches to cash only to once again fully allocate to equities with perfect timing gains 159 basis points of additional annualized return, 1.59%. This is a shockingly small benefit given the remarkable conditions under which such gain would be required – for perfect knowledge of pending recessions and the subsequent expansion the investor would only gain 159 bps of additional annualized return over a strategy which simply rode out the recession and maintained stable equity exposure.

Market timing is a dangerous game. In the real world there simply are not reliable signals which could consistently and accurately facilitate a tactical trading strategy. Most signals either miss the top or miss the bottom or both. The picture is clouded even more when human bias and judgment are introduced, fear and greed necessarily cause the timing to drift, even further degrading performance over time.

Historical context suggests that a typical recessionary market correction is on the order of -34.0% while a non-recessionary correction is a much tamer -16.5%, figure 2. In so far as this knowledge mitigates bias and inspires a steady hand there is value. Consistent equity exposure is a powerful tool and even though it is not fun to watch a correction unfold investors who can suppress their urge to constantly adjust their portfolios stand to benefit.

[1] Philips, Thomas K.; A Simple Real-Time Algorithm to Identify Turning Points in U.S. Business Cycles, NYU Tandon School of Engineering, Brooklyn, NY, August 4, 2024.