Investing with style, the most legendary investors know how to do this, they demonstrate an almost uncanny sense for knowing what to buy and when. But it is difficult to take a cross section of these legends and find a consistent methodology that can be followed. Or is it?

The best investors, for all their differences, consistently understand style investing. They buy the under-appreciated asset, the one that isn’t given enough credit by the broader market. Or perhaps they buy the hot new trend, the asset whose value is sure to continue accelerating and perhaps go hyperbolic. They buy the asset with an untouchable economic advantage, the one with insane profitability, and brand equity, that is indispensable to their customer base. Value investing, Momentum investing, Quality investing these are the most prominent and shining examples of “style investing” (though there are more) that are consistently exploited by the investors who compound wealth with an almost ethereal touch.

Each of these investment methodologies works, each has a long history of success, and each delivers results thorough market pricing mechanisms that are well articulated, defensible, backed by research, and accessible to modern investors.

There are acolytes in each camp, those who eschew all but their chosen method, they follow the edicts and methodologies of their beloved style with an almost religious fervor. For every value investor who would never “overpay” for an asset there is an equally dedicated momentum investor who sees beaten up downtrodden assets as “cheap for a reason.”

There are many things that are misunderstood about style investing but for the investor who aspires to achieve what seems to come so easily to the greats there are two foundational questions that are especially relevant.

1. Why am I getting paid for holding this asset. What are the market pricing mechanisms that I am exploiting to achieve durable and lasting returns over time. In other words, what is style investing, why does it work, and where is it found.

2. Who is right, which style is best. Should I be a value investor, should I be a momentum investor, or do I only buy quality assets with perhaps only a fleeting appreciation for the price paid.

A framework for beginning to answer both questions as presented through cars:

“Buying cars is a bad investment decision, cars are a depreciating asset that are at best an indulgence but never an investment”

This statement is largely true, though for the purposes of building an understanding of style investing and because, like all overgeneralizations, there are advantages to be had for the brave few that go against conventional wisdom, let’s examine some examples of car purchases that have actually been a good idea, at least relatively speaking. The following analysis is not meant to suggest that cars are a good investment, important considerations like holding costs, tax, title, and licensing fees are completely ignored here, the point is not to advocate for investing in cars but instead to develop a relatable framework for style investing more broadly.

Used Car Make/Model and the Style Factor which they represent:

BMW E30 M3 – The “Value” Play.

Value investing is all about finding an under-appreciated asset whose price has disconnected from its true potential. Value is the phenomenon where assets which appear cheap outperform assets which appear expensive.[1] Rationalizations for why assets achieve such status largely fall under two paradigms, these are either behavioral based and draw upon errors in human judgment/heuristics, or they are risk based and draw upon rational payoffs for holding a relatively riskier asset. Behavioral justifications for the value effect tend to focus on the tendency for investors to over-extrapolate the current (bad) conditions. Risk based justifications identify these assets as overly sensitive to distress, obsolescence, or failure.

When purchased new the E30 BMW M3 had an MSRP of $34,000 (not adjusted for inflation) and was sold in the U.S. market between 1988 and 1992. Prices declined rather precipitously in the years following the production run especially upon the release of the next generation E36 M3 that, in comparison, was more powerful and substantially more refined. The E30 M3 was additionally troubled as it commanded a premium over the lesser “base model” E30 325is without much to show for that premium in the way of a performance boost.

A used BMW E30 M3 could have been purchased anytime between 1995 and 2003 for under $15,000 (a decline of over 50% from MSRP), with some examples fetching under $10,000. Prices for E30 M3’s began edging above $100,000 during the CoVid spike and have since settled around $90,000. A savvy value investor could have purchased one of these for $10k - $15k in 2000 and realized a potential 10x in appreciation over the last 25 years (a compounded annualized growth rate of 9.6%).

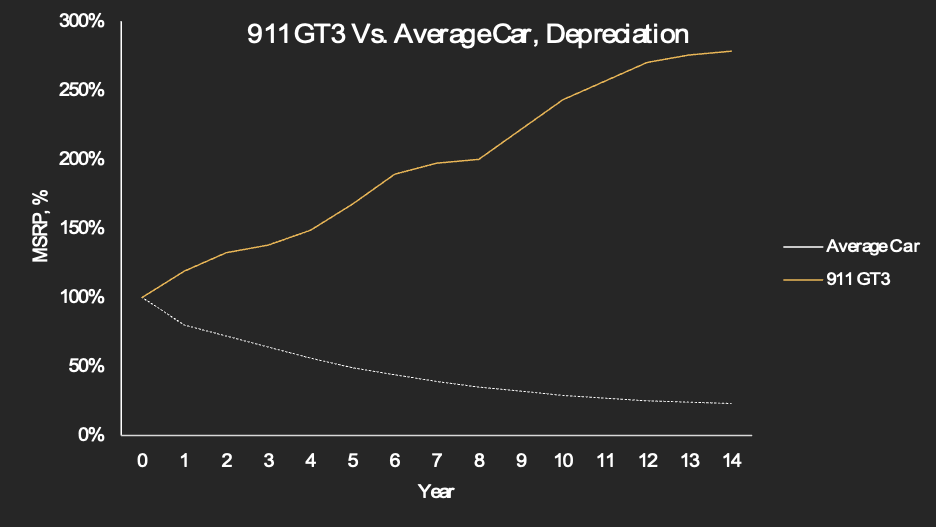

Porsche 997 generation 911 GT3 RS 4.0 – The “Momentum” Play

Momentum investing is not the opposite of value investing. Momentum assets are those whose values are expected to deliver strong appreciation based on recent strong performance. Momentum assets are not simply the “expensive” assets (this would be the opposite of value) instead they are the ones whose recent strong price performance suggests continued appreciation. Like with value the rationalizations for why the momentum factor exists fall largely under two paradigms. Behavioral based justifications for momentum offer that markets are slow to react to new information (anchoring bias), or even potentially that the disposition effect is at play (investors sell winners too quickly and hold on to losers in hope of a rebound). Risk based justifications for momentum argue that momentum assets are more sensitive to economic shocks and therefore command higher risk premiums.

Porsche released the RS version of the 997 GT3 in 2011with an MSRP of $185,000. Prices for this car on the used market have never dipped below MSRP. Current average sale prices for the 2011 911 GT3 RS 4.0 are now comfortably in the $500,000 range with some examples exceeding even that. The 2011 GT3 RS 4.0 was a manual transmission car, made in limited numbers, was the last of a generation, and the last GT3 with the legendary “Mezger” engine powering the car and so not surprisingly this car achieved almost instant collector status. CAGR on a 2011 purchased new at $185,000 and recently sold at $500,000 is 7.3%; though notably it is not rare to see prices well north of $500k on the open market with CAGR’s thus above 10%.

Fifth Generation Toyota 4Runner TRD Pro, specifically in the Colorado Market – The “Quality” Play.

Quality investing is the practice of buying assets with strong fundamentals with the expectation that they will outperform those with weak fundamentals. For stocks this means focusing on things like strong profitability, impeccable balance sheets, and durable economic advantages. The risk-based justification for why this works centers around the idea that these types of companies by nature of their capacity to generate cash flow and returns face a higher cost of capital than their peer group thus reducing the set of investment opportunities that make sense. A higher cost of capital means a higher hurdle rate for new potential investments and thus results in a diminished opportunity set for the deployment of capital. The behavioral based justification for the existence of the quality premium says that investors consistently underreact to current and past quality metrics and inappropriately penalize future capacity to sustain strong results. Other behavioral based rationales for the persistence of the quality premium cite overconfidence and investor preferences for riskier stocks with higher upside potential, simplistic valuation approaches, and a preference for potential short-term gains.

The Toyota 4Runner TRD Pro is a good stand in for this type of investment asset. It’s durable, reliable, and useful, a remarkably stable and safe bet for the automotive shopper. It’s not flashy but is held in high regard. The brand equity for the 4Runner is borderline legendary. These cars are not exactly cheap, but they aren’t quite expensive either.

A 2019 Toyota 4Runner TRD Pro was offered with an MSRP of $40,000. The popularity of these cars in markets that favor their utilitarian nature has caused resale prices to drift above MSRP. Recent sales in the Colorado market are averaging around $46k representing a CAGR of around 2.3%.

Notice that while each investment style, demonstrated here via different car purchases, “beats the average” over the given time period this is not to say that these particular cars will continue to appreciate going forward. The status of each as representative of their respective investment styles is less obvious when considering the future, the next investment window. The E30 M3 for example, given the current lofty price point, may no longer be a “value” play.

It is also worth noting that although each of these examples did beat the average over the window given this is not always the case with style investing. In the broader investment universe (investing in equities for example) it is well established that each style, Value, Momentum, or Quality will sometimes have periods of underperformance – this is expected and is a feature of taking exposure to each of these investment styles. If each of these styles “pays” at least in some part as compensation for bearing risk then it can be expected that sometimes the risk being borne will result in periods of underperformance.

And so, to the second question posed earlier – “which style is best”. The answer: All of the styles are best, each performs, though often at different times. A portfolio which strategically blends exposure to each of the styles will be insulated from periods of underperformance in each especially if the exposures are constructed in a way that minimizes correlation between each.

Ferrari Fantasies & The Real Game of Style Investing

Tying it all together. A fast-lane primer for people who already play in the major leagues

Why the Legends Keep Winning

Strip away the folklore and the greats do one thing better than everyone else: they own a style edge. Sometimes it’s buying what’s hated and mis-priced; other times it’s piling into what’s screaming higher; or, just as often, it’s holding the fortress-balance-sheet name the market chronically undervalues. Call the buckets Value, Momentum, and Quality. Nail each at the right moment and you compound wealth with the casual swagger of a Mille Miglia veteran.

Two Questions That Separate Amateurs from Architects

What am I really being paid for?

Understand the specific mispricing, behavioral or risk-based, that puts cash in your pocket.Which style is “best”?

Trick question. All three work; none work all the time. Allocate like a tactician, not a zealot.

The Metal That Explains It All

Key Takeaways from the Garage

Value wins when pessimism peaks. You’re paid for tolerating “obsolescence” headlines.

Momentum wins while the narrative is still writing itself. You’re paid for being early in, late out.

Quality wins quietly, every year you’re not repairing junk. You’re paid for patience and certainty of cash flow.

So, Should You Ever Buy a Ferrari?

If it’s a style bet that makes sense on the grid you play in—absolutely. But remember: every car above beat “the market” ex post; tomorrow’s winners won’t be this obvious. Rotate styles, size positions, and respect the cost of being wrong.

Portfolio Play: Own all three factors, weighted to their opportunity set not your ego. That blend mutes drawdowns, spikes upside, and frees mental bandwidth for the next asymmetric idea.

Bottom line: Style investing is less about crystal balls, more about disciplined exposure to repeatable mispricing’s. Whether you express that edge through equities, real estate, or a limited-run V12 is simply a matter of taste and garage space.

[1] Asness, Clifford, and Frazzini, Andrea and Israel, Ronen, and Moskowitz, Tobias. Fact Fiction and Value Investing. Journal of Portfolio Management. Fall 2015