BONDS ARE BORING. Meet Gold, Digital Gold, Art! and Real Estate

As an alternative to Bonds, Gold isn’t the only game in town. Crypto, Real Estate, Carbon Credits and Fine Art are now seen as options for hedging against turmoil in the markets.

Gold is the original safe haven

Gold bars and coins have long been a go-to refuge for investors in turbulent time.

They tend to perform the best when uncertainty is the highest.

This is especially so for inflation and geopolitical crises.

During the 2022 inflation spike, for instance, many expected gold to skyrocket, instead it mostly held its value even as stocks and bonds fell, thus preserving capital when other assets faltered. And once interest rate hikes began to ease in 2023, gold’s price climbed more decisively again, aided by persistent inflation and surging demand from central banks.

In 2022 and 2023, central banks bought over 1,000 metric tons of gold each year, twice the annual average of the previous decade.

Emerging market central banks, in particular, take the point of view that gold is a “neutral” asset free from the political risks of reserve currencies. While the interest of retail investors ebbs and flows, the purchases made by these central banks provide a strong backbone of demand for the gold market. During the US-China trade war that occurred earlier this year, gold prices hit an all-time high of $3,100/oz in 2025.

The attributes of Gold as a hedge:

Risk: Low to moderate. Gold is time-tested, geopolitically neutral, and doesn’t rely on someone else’s promise to pay.

Return: Historically modest. Its long-term real return is near zero, but it excels in crises.

Liquidity: Very high. Gold markets are deep and global; you can sell gold nearly anywhere, anytime.

Trade-Off: Stability comes at the cost of consistent returns. Gold is a physical asset which must be procured and stored. It’s not quite cash stuffed in the mattress but there are considerations here.

Silver is “poor man’s gold”

In general, precious metals are a bedrock of safe havens. They are globally recognized, highly liquid, and most importantly they are not the liability of some other entity. They just aren’t.

Silver often rallies in gold’s wake during crises. As gold broke new highs early in 2025, spot silver jumped 2.5% in a single day. Although silver is more volatile (given its heavy industrial use), much like gold it is a tangible asset that can hold value when paper assets plunge.

Silver and gold are exceptions in the world of precious metals. Platinum and palladium may infrequently be referred to as safe havens, but they really tend to behave more like commodities tied to specific industries.

Cryptocurrencies are digital gold

Once dismissed as a speculative fad, Bitcoin is now viewed by some investors as “digital gold.”

Check out the evidence (at least during recently). Since April of 2025, Gold and Bitcoin have outperformed traditional assets like equities and oil.

Bitcoin as a safe haven? Sounds far-fetched. But the idea has gained traction and has in fact, intensified in 2024 through 2025. Note the behavior of bitcoin has begun to mimic that of gold during the recent market sell-offs.

Bitcoin and its companion cryptocurrencies have gone from a purely speculative asset to an asset that is now regarded by some as a legitimate hedge against inflation and currency erosion. This is especially true of younger investors.

In truth, Bitcoin’s record as a safe haven is mixed. It was up over 1,000% during the COVID crash in March of 2020. Astronomical.

How come?

Here’s why.

Much like gold and silver, Bitcoin is stateless. It is not tied to the fate of any one country or economic policy. It operates on a decentralized network beyond the reach of central banks and governments. That foundation makes Bitcoin a digital counterpart to gold and the stateless nature of both.

As an illustration, recall the banking crisis in March of 2023? Several US banks collapsed. Bitcoin followed suit, along with other traditional assets. But whoa. It rapidly rebounded and began to outperform. It existed outside of the traditional banking system that was under threat at the time. During the tariff sell off that occurred in April 2025, Bitcoin dropped but it was much less than tech stocks.

As the cryptomarket is maturing, Bitcoin seems to be evolving into a safe haven category.

A non-sovereign store of value and recently correlated with Gold.

There is bad news though. Bitcoin is notorious for its volatility. We can’t ignore that. There have been past panics in which it has behaved like a high beta speculative asset. Critics argue that Bitcoin is not a safe haven, but is simply a gamble. Defenders counter that the volatility we observe in Bitcoin is the price of its independent nature.

Please recognize that, unlike gold, Bitcoin and its counterparts remain an adolescent asset class. When examined over a longer time period, the trajectory of Bitcoin as an asset class is impressive and has zero correlation to bonds and infrequently correlated to equities.

Not bad. Especially in light of the globally liquid 24/7, decentralized resistance to capital controls or tariffs. At the very least those features have attracted many in unstable economies.

Argentina and Turkey are prime examples. Compared to an 18% of the global population, Turkey reports in at 27% and Argentina at 23% of the population investing in crypto.

One caveat: much of the buying of safe haven crypto in not necessarily in Bitcoin, but in digital tokens pegged to the US dollar. Stablecoins. Tokens like USDC or Tether hold steady at $1.00 and are seen as a lifeline.

What should we make of that?

It means that in some economies where local financial chaos reigns, crypto or Bitcoin itself, acts as a vehicle to proxy for a stable currency.

Bitcoin may not have fully proven itself the equal of gold as “digital gold” just yet, but its role is expanding. Regulators are catching up. China has essentially banned crypto trading pushing investors back to gold or real estate. The US is gradually incorporating crypto into the regulated financial system that exists in this country. We have now crypto-themed exchange traded funds (ETFs). The rules here are clearer and institutional investors are also starting to take note.

In the words of one unnamed investment firm: As “politically neutral assets” like cryptocurrencies exist outside traditional financial systems they are likely to become more enduring safe havens over time.

Attributes of Bitcoin as a hedge:

Risk: High. Bitcoin can swing wildly in value, sometimes in response to a tweet.

Return: Potentially enormous, but speculative. It has delivered astronomical gains, but also gut wrenching drawdowns.

Liquidity: Moderate to high. Easily tradable 24/7, but vulnerable to regulatory disruptions and platform risk.

Trade-Off: Independence and upside in exchange for volatility. It is difficult if not impossible to discern the true intrinsic value of cryptocurrency, much of the performance is driven by speculation and sentiment.

Real Estate is a tangible place to hide your money.

“Buy land, they’re not making it anymore.” – Mark Twain

While not a “new” place to invest, real estate is an intriguing option for stable and tax efficient returns. Wealthy families have purchased real estate for generations and holding on has continued to keep them wealthy. It is easy for investors to get comfortable with a tangible, cash flow producing asset.

Warren Buffet has said “I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.” Real estate is the perfect business that even an idiot can run. And its illiquidity makes it difficult to sell in a panic.

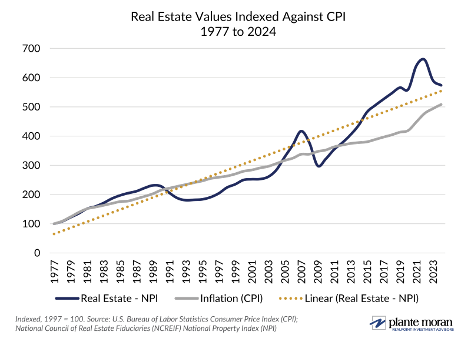

Important to real estate as an asset class: it has proven to be a hedge against inflation. Both prices and yields adjust with short term inflation.

People will always need a place to live and companies will need locations to operate. Real estate is connected to the health of the overall economy but a priority expense for all.

The major risks?

Real estate transactions are highly levered and sensitive to shifts in interest rates. Refinancing a loan when banks don’t want to or can’t lend is a problem.

Lifestyle preferences and societal shifts can make certain types of real estate obsolete. Owning class A office buildings in downtown locations was a safe investment… until it was not.

Real estate performance is correlated with long term economic and population growth. Assets in flat or declining markets can struggle.

Attributes of Real Estate as a hedge:

Risk: Moderate. Asset values are generally stable, but vulnerable to interest rate spikes and local economic shifts.

Return: Historically strong and inflation-resistant, especially in farmland.

Liquidity: Low. These assets take time (and paperwork) to convert to cash.

Trade-Off: Durable value and income at the expense of flexibility.

Art - a venue for perfectly legal market manipulation?

“Artists are here to disturb the peace[1]”

Art can be the expression of a collective feeling or can be a flashpoint for enduring cultural change. Consider Katsushika Hokusai’s “The Great Wave of Kanagawa” which channels the angst that the 19th century Japanese were feeling as an entire culture sat on the threshold of modernization[2].

Art is one of humanity’s most important and powerful creations, and yet Art has no intrinsic value. Investing in art can be an incredible opportunity to witness, to own, or to display a moment in history. It can be a way to physically participate in the entire sentiment of a culture that was expressed at some point in the past. Investing in art can be many things but is art a safe haven, is it a store of value, or even a vehicle for capital appreciation?

The global market for fine art is small[3], concentrated, and easily exploited.

In 2024 global sales of fine art achieved an estimated $57.5 billion. For context, in 2024, sixty-six of S&P 500 companies delivered annual sales that exceeded that amount. Apple, a single company, generated revenue of $391 billion in 2024 which is nearly 7x the entire global market for art.

Art sales are concentrated within only a few select markets (the US, China, and the UK accounted for 70% of total sales) and are transacted largely at the behest of only two auction houses, Christie’s and Sotheby’s1. Fewer than 6,000 unique buyers were active across all public art markets in 2024, and fewer than 250 were active in the crucial above $1 million space1.

Art has no intrinsic value. It’s actually more like a popularity contest. Its value is determined not by its capacity to produce a good or service, by its utility as a resource, or by its ability to generate a stream of cash flows.

Art is an asset in the sense that there is an expectation for future income generation and/or expense reduction but the value of art is completely dictated by its desirability amongst a very concentrated chain of buyers, dealers, and auction houses in only three select markets.

One hundred percent of the value of a given piece is dictated by what someone else will pay, it has value because interested parties say that it does, it’s a popularity contest and the sellers get to decide who is popular.

If a new artist coming on the scene is somehow picked up by a reputable gallery, or dealer and said dealer is able to successfully generate some hype and a following, only then values might increase.

The necessary conditions for such appreciation in value are not necessarily governed by the raw talent of the artist, their medium, or their vision. These are all relevant but its more about how effectively a reputable and influential dealer is able to market these to buyers that really matters. If this is all done successfully the value of the artists’ pieces can catapult into the tens of thousands, or potentially, in select cases, the millions.

If said artist only generates maybe a hundred marketable pieces in their lifetime it becomes relatively easy for a determined collector to bid up the prices of these pieces. A given collector (depending on their bank roll and influence within a concentrated and rarified market) can very easily corner the market for a single artist and dictate where values ultimately end up.

The motivations for successfully playing this game are many but only a few are notable.

Say for example that a singular artist successfully navigates this shadowy landscape and manages to gain enough notoriety that his/her pieces are regularly commanding $100,000 each at auction and manages to produce 100 pieces of art in his/her lifetime. Once that artist is no longer making new art a motivated collector could build a controlling position in the market for this art, say 60 pieces for a total outlay of $6 million.

With this controlling position, their relationships within the art network, and some strategic buying and selling the collector could potentially bid up the value of the artists work. If the collector does this over a number of years and manages to get prices up to 2.5x their original value ($250,000) the collector is now sitting on $15 million worth of art.

A single piece bought at $100,000 that is managed to now be worth $250,000 could be sold or just as easily could be donated to an appropriate entity generating a tax write off for $100,000 at a 40% marginal tax rate.

Some pieces, say Hokusai’s Great Wave do not require such tactics. Their place in history, the visibility and their renowned are already well established. Even here though the forces that dictate value are fickle and are dominated by similar mechanisms.

Is art a safe haven? It can be but as an asset with no intrinsic value where prices are set in an obfuscated market dominated by a select few art as a safe haven investment is best left to the sufficiently motivated, active, and connected collectors.

Tempting and glamorous, but not appropriate for the average investor!

Attributes of Art as a hedge:

Risk: High. Subjective valuations, limited buyer pools, and taste-driven demand.

Return: Can be stellar for top-tier pieces, but requires not insignificant effort by the collector to achieve maximum results.

Liquidity: Very low. Selling fast can be painful and costly.

Trade-Off: Not a passive store of wealth.

Our Final Thought: Know Your Hedge

The tradeoffs between risk, return and liquidity are important.

Remember, Safety is the objective.

Whether you're turning to gold, Bitcoin, real estate, or fine art, every alternative safe haven asset presents a different profile of risk, return, and liquidity. Understanding where each asset falls on this spectrum is key to building a resilient portfolio that will survive the chaos.

Diversification across several safe haven assets may be the smartest form of modern risk management.

[1] Madonna. The Tonight Show with Jimmy Fallon. YouTube, uploaded by The Tonight Show Starring Jimmy Fallon, October 2021.

[2] Witek, Dominic (2022 March 12). Understanding Hokusai’s The Great Wave. Artsper Magazine. https://blog.artsper.com/en/a-closer-look/understanding-hokusais-the-great-wave/

[3] McAndrew C., Art Market Report 2025 by Arts Economics, Art Basel and UBS. Retrieved from: https://theartmarket.artbasel.com/