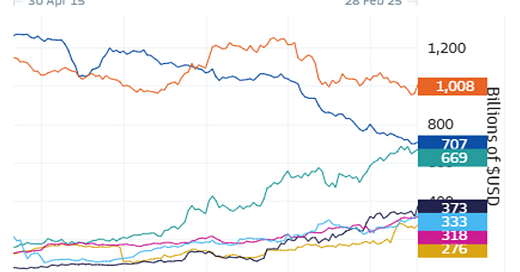

For decades, U.S. Treasuries have been the ultimate "safe harbor" for investors whenever things got dicey in the capital markets. The $28-plus trillion Treasury market is unmatched in terms of its liquidity and until recently, its stability. Take a look at the 7 top holders of Treasury securities as of February 28, 2025. Note that over the last 10 years, Canada, Luxembourg, Cayman Islands, the UK and Belgium have increased holdings, while China and Japan have decreased holdings.

Interesting, huh? Not entirely what I expected.

From financial crisis to financial crisis (say for example, the 2008 global financial crisis to the pandemic panic of 2020), investors have typically rushed into Treasuries whenever trouble hits, pushing prices up and yields down. Treasuries have been seen by the world as the safe haven for investors. The idea being that Treasury performance is at least somewhat uncorrelated from the performance of other assets: when prices on other assets are falling, prices on treasuries are hopefully rising.

But lately, confidence in U.S. stability is no longer a given and the reputation of the Treasury market as a safe haven has come under scrutiny. For example, when the unexpected inflation spike in 2022 occurred, the Fed jacked up interest rates. Stocks fell, and bonds fell too! It seemed that everything fell. So much for the uncorrelated part.

So, it’s a fair question: Do Treasuries still deserve their reputation as the ultimate financial refuge?

The short answer is YES, however, they are not infallible.

The combination of stubborn inflation, fiscal strain and the current economic turmoil have introduced a new element of volatility that has complicated the question. As a result of the increased volatility in the Treasury market, investors have reacted naturally by assessing what the term “safe haven” really means.

And why? The best explanation points to the relationship between high inflation and the growing mountain of debt in the US. Let’s talk about how the proponents of “Treasuries-are-actually-on-shaky-ground” make their argument.

ü The US has experienced inflation surprises and interest rate surprises. When inflation unexpectedly jumped above 9% (energy, food and shelter) in 2022, the Fed responded by hiking interest rates from practically zero to over 5%. Prices of Treasuries dropped. That was the biggest and fastest jump in decades, making 2022 one of the worst years ever for Treasury securities.

Then investors began selling Treasuries even as the prices of stocks fell. This is not the usual response and was unusual enough to cause everyone to question the “safe-haven” status of the Treasury market. Equity portfolios fell, so too did the so called balanced or blended “60/40” portfolios.

ü Now, let’s talk about high inflation and Fed policy. All else held equal, if the recent inflation spike truly subsides – that is, core inflation keeps trending toward the Fed’s 2% target – then U.S. Treasuries could firmly reestablish themselves as a go-to safe asset. In a low-inflation world, 3-4% Treasuries would be very attractive and in-demand in a risk-off scenario. Treasuries might then “behave”, in the traditional sense, rallying when stock prices decline. This would go a long way to restoring confidence in the role of Treasuries as a portfolio hedge.

If however, inflation reaccelerates, the safe-haven utility of Treasuries might be hampered, and the real rate of return may suffer as well. Remember, it is key that Treasuries remain the first and best option for preserving purchasing power, and not just providing a nominal return.

Keep in mind where we are with respect to the CPI vs. the Fed’s target rate:

Now, compare that to the latest Michigan survey on inflation expectations over the next five years—4.4%, twice the current rate!

Not exactly heartwarming news.

The Fed’s reputation is on the line here. Investors want to see positive real returns delivered on a consistent basis in order to support the appeal of Treasuries. If the Fed tamps down inflation, trust is restored. If it wavers and inflation begins to reaccelerate then problems may emerge.

✓ But have Treasuries lost their Luster entirely? No. Not entirely. As recently as 2023, in the banking scares (remember Silicon Valley Bank?) investors rushed back in, buying short-term Treasuries. Yields dropped, prices went up. That was a classic “flight to quality” reaction. It seemed that Treasuries were still a comfort to investors when a financial crisis popped up.

There was a snag though. The picture was complicated by the political drama surrounding the debt ceiling question. Recall 2023, when such drama caused fears of a US default and rating agencies responded by stripping the US of its coveted AAA credit rating. Okay, it was only one rating agency, Fitch Ratings. Even though US debt is typically considered “risk-free” Fitch and investors started to become wary of the near constant political infighting and its impact on the riskiness of the Treasury market.

The geopolitics and gamesmanship of the current administration are not doing Treasuries any favors. Investors now worry that continued and prolonged disruptions in global trade will weaken the attractiveness and leadership of the US on a global scale.

A self-inflicted wound? Shooting ourselves in the foot? Maybe both feet.

The sheer scale of US borrowing needs is front and center in this debate. The country is piling on large amounts of debt to fund the budget and the deficit. The Fitch downgrade to AA+ in 2023 was just a shot across the bow. If demand for US Treasuries does not keep up then rates will remain pressured.

Remember the term “bond vigilantes”? It was coined by economist Ed Yardeni in the 1980s and refers to the situation where investors demand higher yields as compensation for perceived increases in risk. At the time, Yardeni argued that bond investors were rebelling against excessive government borrowing much like vigilantes who try to enforce the law without the proper authority.

Think about that! Will the bond vigilantes return to the scene in 2025, especially if the debt and deficit continue to grow.

The bottom line is that Treasuries are not acting dependably. The Treasury market sells off when their prices should rise. Understandably, investors are now asking if it is time to consider alternative shelters.

The cracks are beginning to show.

Take a look at the mounting value of total public debt in the US:

Yes, the rising debt and persistent deficits are chipping away at investor confidence both at home and globally. Will the heavy debt load someday affect the ability of the US to repay?

A heavily levered U.S. government may find its options limited during future crises. Investors (“vigilantes”?) may begin demanding higher yields—compensation for taking on additional risk—thus creating higher borrowing costs for the government. Will "bond vigilantism," reappear and set off a negative spiral where rising interest payments further enlarge deficits, reinforcing investor skepticism?

Don’t forget the major credit rating agencies are watching closely. A downgrade could severely dent Treasury's reputation as a secure investment. Even minor shifts in investor perception or a loss of confidence by the largest foreign holders, China or Japan, could quickly ripple through global markets.

We have to be cautious. Here are key indicators of safe haven status:

· U.S. debt ceiling debates-any sign of potential default might spook markets

· Monthly inflation numbers

· Fed meetings especially those indicating policy direction or changes in direction

· Treasury bond auction results in order to gauge demand strength

· Global risk indicators like conflicts in the news, growth data

· The term spread between short and long Treasuries –is it inverted, yikes—recession!

· Investor sentiment, if investors broadly decide “Treasuries are safe again,” they will bid them up in a crisis reflexively, making it true.

· However, if doubt persists…… there are potential substitutes and investors might just start hanging out elsewhere—German bunds, Japanese government bonds, gold and digital currencies are real alternatives.

Stay tuned. That’s another discussion.